At the AEI fiscal theory event last Tuesday Tom Sargent and Eric Leeper made some key points about the current situation, with reference to lessons of history.

Tom's comments updated his excellent paper with George Hall "Three World Wars" (at pnas, summary essay in the Hoover Conference volume). Tom and George liken covid to a war: a large emergency requiring immense expenditure. We can quibble about "require" but not the expenditure.

(2008 was a little war in this sense as well.) Since outlays are well ahead of receipts, these huge temporary expenditures are financed by issuing debt and printing money, as optimal tax theory says they should be.

In all three cases, you see a ratcheting up of outlays after the war. That's happening now, and in 2008, just as in WWI and WWII.

After WWI and WWII, there is a period of primary surpluses -- tax receipts greater than spending -- which helps to pay back the debt. This time is notable for the absence of that effect.

We see that most clearly by plotting the primary deficits directly. The data update since Tom and George's original paper (dots) makes that clear. To a fiscal theorist, this is a worrisome difference. We are not following historical tradition of regular, full employment, peacetime surpluses.

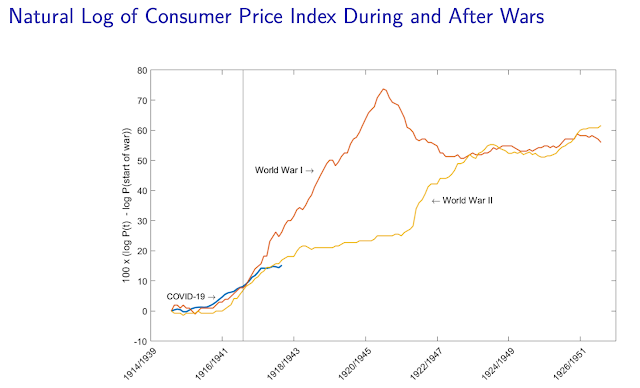

The two world wars were also financed by a considerable inflation. The important consequence of inflation is that it inflates away government debt. Essentially, we pay for part of the war by a default on debt, engineered via inflation.

1947 is an interesting case. As now, inflation broke out, the Fed left interest rates alone, and the inflation went away once it had inflated away enough debt. That too is an interesting episode in the debate whether the Fed must move rates more than one for one to keep inflation from spiraling away.

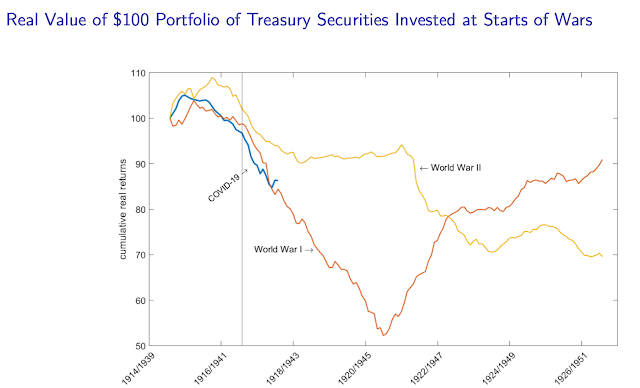

The effect of inflation is clearer in the next graph, which plots the real return on government bonds:

Yes, the inflation of 1920 did inflate away a lot of the WWI debt, though the deflation of 1921 brought a lot of that back. (This is an episode we would do well to remember more! The price level

doubled from 1916 through 1920. It then retreated by a third in 1920-1921. There was a sharp recession, but the economy recovered very quickly with no stimulus or heroic measures. The conventional wisdom that wringing out WWI inflation caused the UK 1920s doldrums needs to consider this counterexample. But back to our point)

This is also consistent with standard optimal tax theory, which says that in the event of a disaster that happens once every 50 years or so, it is right to execute a "state contingent default" (Lucas and Stokey), and inflation is a natural way to do it.

But... "state contingent default" is supposed to happen at the beginning of a war. These inflations happened at the end of the war. How did governments sell bonds to people who should have expected them to be inflated away? Yes, there were some price controls and financial repression, but it's still an important puzzle to standard public finance theory.

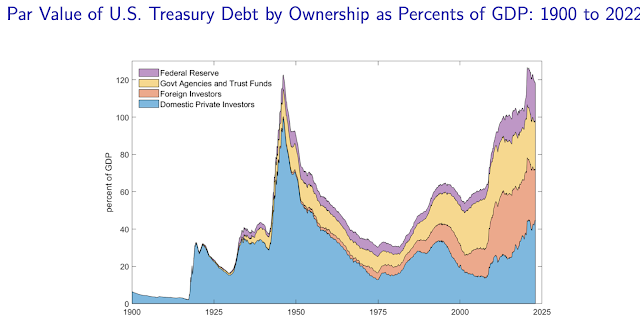

My concern, of course, is that we've had two once in a hundred year events in a row (2008, 2020), I can think of lots more that might come soon, and you can only do this occasionally. Hit people over the head a few too many times and they start to duck. We will head to the next crisis with no history of steady surpluses in good times, 100% debt to GDP ratio, and a painful reminder of what happens if you lend to the US right in the rear view mirror.

We start the H5N1/Taiwan war crisis with the same debt we had at the end of WWII. And who owns the debt leads to some fascinating speculation which I'll let you fill in with your chat GPT.

Tom closed by echoing my favorite bright idea for avoiding the debt limit: Since the limit applies to par value not market value, the Treasury can issue all the perpetuities it wants. That's far better than the trillion dollar coin, though I suspect the Supreme Court would take just as dim a view of it.

Eric brought up a great point from his super

Recovery of 1933 paper with Margaret Jacobson and Bruce Preston.

In 1933, we had a disastrous deflation. The gold standard is a lovely fiscal commitment device to try to contain inflation, but it has an Achilles heel. If there is a deflation, the government has to raise taxes to pay an unexpected real windfall to bondholders. In 1933, the Roosevelt Administration abrogated the gold standard. It was a default on the legal terms of the bonds. And look what happened to inflation!

Eric also brought up a second central point of his 1933 paper: The Roosevelt Administration separated the budget into a "regular" budget, in which we should expect deficits to be paid back, and an "emergency" budget, unbacked (in our language) by expected surpluses. That cleverly allowed inflationary finance in 1933, but once the "emergency" was over in 1941, it preserved the US reputation for repaying wartime debts with subsequent surpluses, and allowed it to borrow for WWII. This loss of "back to normal," of expectations that we are now in "regular" not "emergency" finance is worrisome today.

Finally, Eric brought some nice evidence to bear on the question, why 2020 but not 2008? Well, in part, we can look at statements of public officials. In 2008, they explicitly said, deficit now, repayment later. In 2020 they explicitly said the opposite.

("Offsets" is Washington-speak for "taxes" or later spending cuts.) Don't read a pejorative in this analysis. If you want to borrow, finance crisis expenditures and not create inflation, you "maintain the norm." If you want to create a "state contingent default" and pay for crisis expenditures by inflating away debt, you have to "violate the norm." That is darn hard -- ask the Japanese. How do you convince people you're not going to repay some part of the debt, despite a good reputation, but just some part, and if WWII comes along you're good for additional debts? Well, announcing your intentions helps!

And it worked. We very quickly inflated away the debt. Creating a state contingent default via inflation is not easy. Still to be seen though is whether we can return to "normal" "Hamilton norm" once it's over.

Robert Barro also had great comments, but more directed at the book and with no great graphs to pass along. Thanks anyway!

Tidak ada komentar:

Posting Komentar