With amazing speed and impeccable timing, Erica Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru analyze how exposed the rest of the banking system is to an interest rate rise.

Recap: SVB failed, basically, because it funded a portfolio of long-term bonds and loans with run-prone uninsured deposits. Interest rates rose, the market value of the assets fell below the value of the deposits. When people wanted their money back, the bank would have to sell at low prices, and there would not be enough for everyone. Depositors ran to be the first to get their money out. In my previous post, I expressed astonishment that the immense bank regulatory apparatus did not notice this huge and elementary risk. It takes putting 2+2 together: lots of uninsured deposits, big interest rate risk exposure. But 2+2=4 is not advanced math.

How widespread is this issue? And how widespread is the regulatory failure? One would think, as you put on the parachute before jumping out of a plane, that the Fed would have checked that raising interest rates to combat inflation would not tank lots of banks.

Banks are allowed to report the "hold to maturity" "book value" or face value of long term assets. If a bank bought a bond for $100 (book value) or if a bond promises $100 in 10 years (hold to maturity value), basically, the bank may say it's worth $100, even though the bank might only be able to sell the bond for $75 if they need to stop a run. So one way to put the issue is, how much lower are mark to market values than book values?

The paper (abstract):

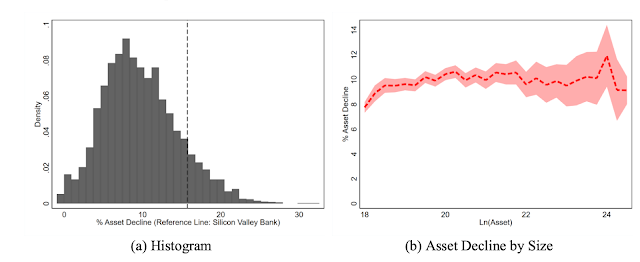

The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity. Marked-to-market bank assets have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%.

... 10 percent of banks have larger unrecognized losses than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent of banks have lower capitalization than SVB. On the other hand, SVB had a disproportional share of uninsured funding: only 1 percent of banks had higher uninsured leverage.

... Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk. ... these calculations suggests that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs.

Data:

we use bank call report data capturing asset and liability composition of all US banks (over 4800 institutions) combined with market-level prices of long-duration assets.

How big and widespread are unrecognized losses?

The average banks’ unrealized losses are around 10% after marking to market. The 5% of banks with worst unrealized losses experience asset declines of about 20%. We note that these losses amount to a stunning 96% of the pre-tightening aggregate bank capitalization.

|

| Percentage of asset value decline when assets are mark-to- market according to market price growth from 2022Q1 to 2023Q1 |

The median bank funds 9% of their assets with equity, 65% with insured deposits, and 26% with uninsured debt comprising uninsured deposits and other debt funding....SVB did stand out from other banks in its distribution of uninsured leverage, the ratio of uninsured debt to assets...SVB was in the 1st percentile of distribution in insured leverage. Over 78 percent of its assets was funded by uninsured deposits.

But it is not totally alone

the 95th percentile [most dangerous] bank uses 52 percent of uninsured debt. For this bank, even if only half of uninsured depositors panic, this leads to a withdrawal of one quarter of total marked to market value of the bank.

|

| Uninsured deposit to asset ratios calculated based on 2022Q1 balance sheets and mark-to-market values |

Overall, though,

...we consider whether the assets in the U.S. banking system are large enough to cover all uninsured deposits. Intuitively, this situation would arise if all uninsured deposits were to run, and the FDIC did not close the bank prior to the run ending. ...virtually all banks (barring two) have enough assets to cover their uninsured deposit obligations. ... there is little reason for uninsured depositors to run.

... SVB, is [was] one of the worst banks in this regard. Its marked-to-market assets are [were] barely enough to cover its uninsured deposits.

Breathe a temporary sigh of relief.

I am struck in the tables by the absence of wholesale funding. Banks used to get a lot of their money from repurchase agreements, commercial paper, and other uninsured and run-prone sources of funding. If that's over, so much the better. But I may be misunderstanding the tables.

Summary: Banks were borrowing short and lending long, and not hedging their interest rate risk. As interest rates rise, bank asset values will fall. That has all sorts of ramifications. But for the moment, there is not a danger of a massive run. And the blanket guarantee on all deposits rules that out anyway.

Their bottom line:

There are several medium-run regulatory responses one can consider to an uninsured deposit crisis. One is to expand even more complex banking regulation on how banks account for mark to market losses. However, such rules and regulation, implemented by myriad of regulators with overlapping jurisdictions might not address the core issue at hand consistently

I love understated prose.

There does need to be retrospective. How are 100,000 pages of rules not enough to spot plain-vanilla duration risk -- no complex derivatives here -- combined with uninsured deposits? If four authors can do this in a weekend, how does the whole Fed and state regulators miss this in a year? (Ok, four really smart and hardworking authors, but still... )

Alternatively, banks could face stricter capital requirement... Discussions of this nature remind us of the heated debate that occurredafter the 2007 financial crisis, which many might argue did not result in sufficient progress on bank capital requirements...

My bottom line (again)

This debacle goes to prove that the whole architecture is hopeless: guarantee depositors and other creditors, regulators will make sure that banks don't take too many risks. If they can't see this, patching the ship again will not work.

If banks channeled all deposits into interest-paying reserves or short-term treasury debt, and financed all long-term lending with long-term liabilities, maturity-matched long-term debt and lots of equity, we would end private sector financial crises forever. Are the benefits of the current system worth it? (Plug for "towards a run-free financial system." "Private sector" because a sovereign debt crisis is something else entirely.)

(A few other issues stand out in the SVB debacle. Apparently SVB did try to issue equity, but the run broke out before they could do so. Apparently, the Fed tried to find a buyer, but the anti-merger sentiments of the administration plus bad memories of how buyers were treated after 2008 stopped that. Beating up on mergers and buyers of bad banks has come back to haunt our regulators.)

Update:

(Thanks to Jonathan Parker) It looks like the methodology does not mark to market derivatives positions. (It would be hard to see how it could do so!) Thus a bank that protects itself with swap contracts would look worse than it actually is. (Translation: Banks can enter a contract that costs nothing, in which they pay a fixed rate of interest and receive a floating rate of interest. When interest rates go up, this contract makes a lot of money! )

Amit confirms,

As we say in our note, due to data limitations, we do not account for interest rate hedges across the banks. As far as we know SVB was not using such hedges...

Of course if they are, one has to ask who is the counterparty to such hedges and be sure they won't similarly blow up. AIG comes to mind.

He adds:

note we don’t account for changes in credit risk on the asset side. All things equal this can make things worse for borrowers and their creditors with increases in interest rates. Think for a moment about real estate borrowers and pressures in sectors such as commercial real estate/offices etc. One could argue this number would be large.

So don't sleep too well.

From an email correspondent:

Besides regulation, accountancy itself is a joke. KPMG Gave SVB, Signature Bank Clean Bill of Health Weeks Before Collapse.

How can unrealised losses near equal to a bank's capital be ignored in the true and fair assessment of its financial condition (the core statement of an audit leaving out all the disclaimers) just because it was classified as Held to Maturity owing some nebulous past "intention" (whatever that was ever worth) not to sell?

It strikes me that both accounting and regulation have become so complicated that they blind intelligent people to obvious elephants in the room.

Tidak ada komentar:

Posting Komentar